As trade tensions simmer globally, the possibility of the United States imposing a 50% tariff on Indian exports could drastically alter the landscape of India’s foreign trade. The U.S. is India’s largest export destination, and such a steep tariff would ripple through multiple sectors, affecting businesses, jobs, and the overall economy.

In this post, we break down the sector-wise impact such a tariff would have, based on current trade dependencies and price sensitivity.

Sector-Wise Impact Analysis

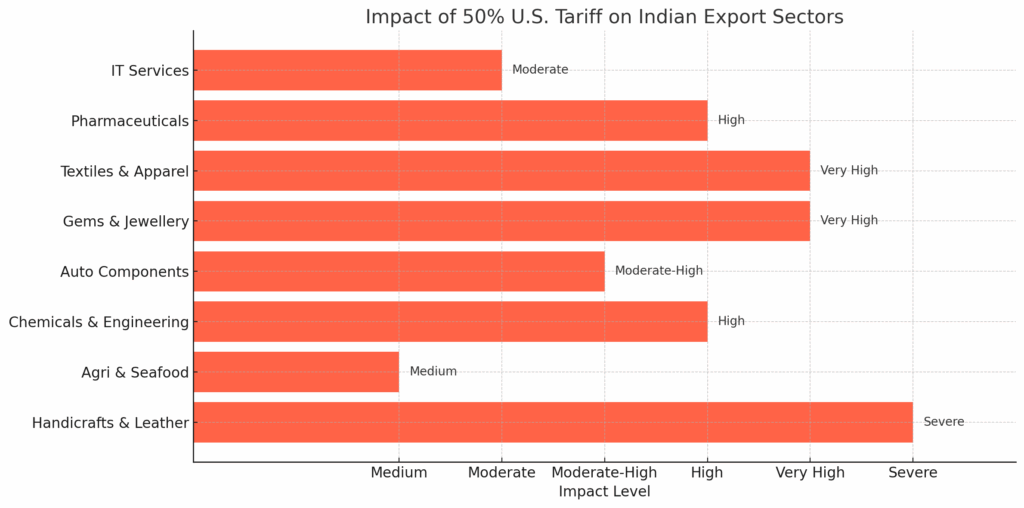

🟧 1. Textiles & Apparel – Very High Impact

India is a global leader in cotton garments, home textiles, and fabrics. A 50% tariff would destroy price competitiveness and shift demand to countries like Bangladesh or Vietnam.

🟧 2. Gems & Jewellery – Very High Impact

The U.S. is the largest buyer of polished diamonds and gold jewellery from India. Such tariffs would severely impact cities like Surat and Mumbai, known for their jewellery export hubs.

🟧 3. Handicrafts & Leather Goods – Severe Impact

These sectors rely heavily on the U.S. market and consist mainly of MSMEs. A 50% hike in price would make Indian goods non-viable, leading to reduced orders and possible shutdowns.

🟨 4. Pharmaceuticals – High Impact

India is a major supplier of generic drugs to the U.S. A steep tariff would:

- Increase drug prices in the U.S.

- Open the market for competitors like China or Mexico

- Hurt pharma majors like Sun Pharma, Lupin, Dr. Reddy’s

🟨 5. Automotive Components – Moderate to High Impact

Auto components are price-sensitive B2B exports. With Mexico and China as alternatives, Indian suppliers may lose key U.S. clients.

🟨 6. Engineering Goods & Chemicals – High Impact

India exports various industrial chemicals, capital goods, and machinery to the U.S. A 50% tariff could disrupt B2B supply chains.

🟩 7. IT & Software Services – Moderate Impact

While not all IT services are subject to tariffs, changes in digital trade policy could affect Indian IT giants if restrictions are extended to software products or cloud-based services.

🟩 8. Agriculture & Seafood – Medium Impact

Exports like rice, spices, tea, and shrimp may be impacted. However, these products have a more diversified global demand.

📉 Macroeconomic Effects

- Export slowdown and fall in foreign exchange earnings

- Job losses in export-dependent sectors

- Pressure on the Indian rupee

- Possible retaliatory tariffs from India on U.S. goods

- Challenges for MSMEs to survive without subsidies or new markets

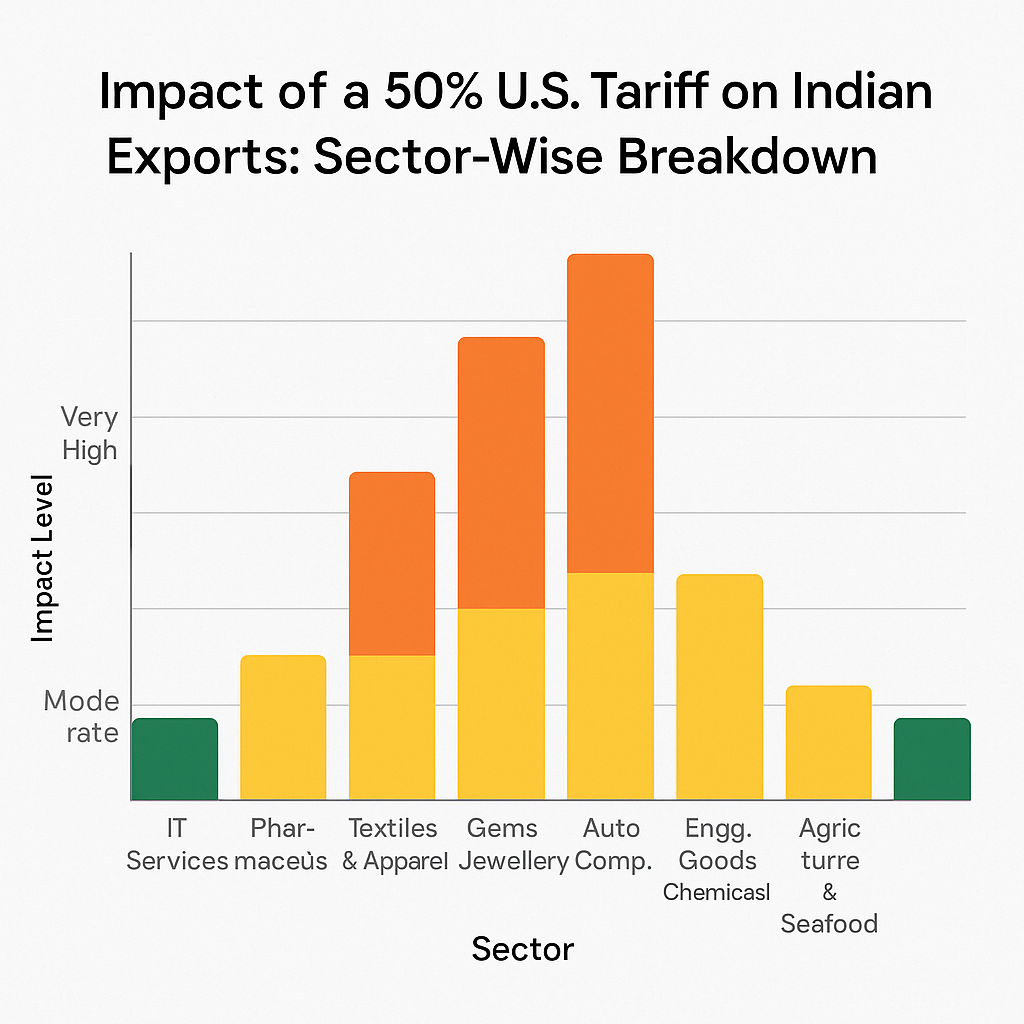

Sector vs Impact Level

Want to see the impact in one glance? Here’s a chart we created to illustrate sectoral sensitivity to U.S. tariffs:

What Can India Do?

- Diversify export markets (Africa, ASEAN, Europe)

- Push for trade agreements (FTA with EU, UK)

- Improve domestic competitiveness via incentives

- Seek WTO dispute resolution if tariffs are unjustified

A sudden 50% tariff from the U.S. would disrupt India’s export engine, hitting key sectors and millions of livelihoods. Policymakers and businesses must prepare with diversification, innovation, and negotiation.

#TradePolicy #IndiaUSRelations #Exports #TariffImpact #Economy #XploroInsights